|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Interest Only Loans: A Comprehensive Guide for Smart BorrowersInterest only loans can be an attractive option for borrowers looking to minimize initial payments. However, understanding the intricacies is key to making informed decisions. This guide explores various aspects of interest only loans, their benefits, and potential pitfalls. Understanding Interest Only LoansInterest only loans allow borrowers to pay only the interest for a set period, typically 5-10 years. This can result in lower initial payments compared to traditional loans. How They WorkDuring the interest-only period, the borrower's monthly payments cover only the interest charges. The principal remains unchanged, which means the borrower doesn't build equity unless the property value increases. Benefits of Interest Only Loans

These benefits make interest only loans appealing, especially for those with fluctuating income or short-term investment plans. Potential DrawbacksDespite the benefits, there are notable risks involved with interest only loans. Common Mistakes to Avoid

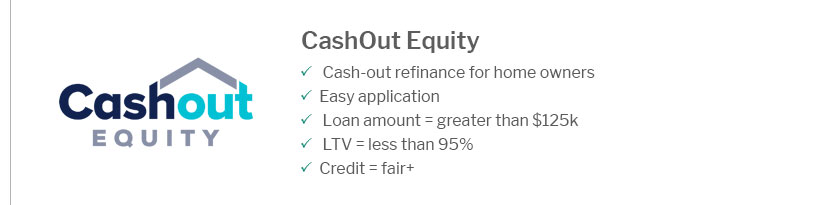

Being aware of these pitfalls helps in making better financial decisions. Choosing the Right LenderFinding the right lender is crucial when considering an interest only loan. Researching OptionsCompare offers from different mortgage companies in Gainesville, FL to find competitive rates and terms. Look for lenders with transparent policies and good customer reviews. Consulting ProfessionalsWorking with financial advisors can provide valuable insights and help tailor the loan to your financial situation. FAQWhat happens after the interest-only period ends?Once the interest-only period concludes, borrowers must start paying both principal and interest, leading to higher monthly payments. It's essential to plan for this transition. Are interest-only loans suitable for everyone?Interest-only loans are not suitable for everyone. They are best for borrowers with specific financial strategies, such as expecting a significant income increase or planning to sell the property before the interest-only period ends. How can I minimize risks associated with interest-only loans?To minimize risks, borrowers should have a clear repayment strategy, consider refinancing options, and consult with financial experts to assess their financial situation regularly. https://www.nerdwallet.com/best/mortgages/interest-only-mortgage-lenders

NerdWallet's Best Interest-Only Mortgage Lenders of 2024 - Rate: Best for variety of jumbo loans - PNC Bank: Best for low jumbo loan origination fees - Flagstar: ... https://www.reddit.com/r/Mortgages/comments/1hfngxf/are_interestonly_mortgages_mostly_just_better/

It's an excellent loan for people with a really sophisticated financial picture where their other investments are likely to have a better yield ... https://www.newamericanfunding.com/loan-types/interest-only/

Qualifying for an interest-only mortgage loan typically requires a good to excellent credit score, a low debt-to-income ratio, and a significant down payment.

|

|---|